RV depreciation is a huge topic — and it can get pretty confusing.

Would you like to know the RV depreciation life, the RV depreciation method, the depreciation on RV used for business or what motorhome holds its value the best? Well, we got you covered.

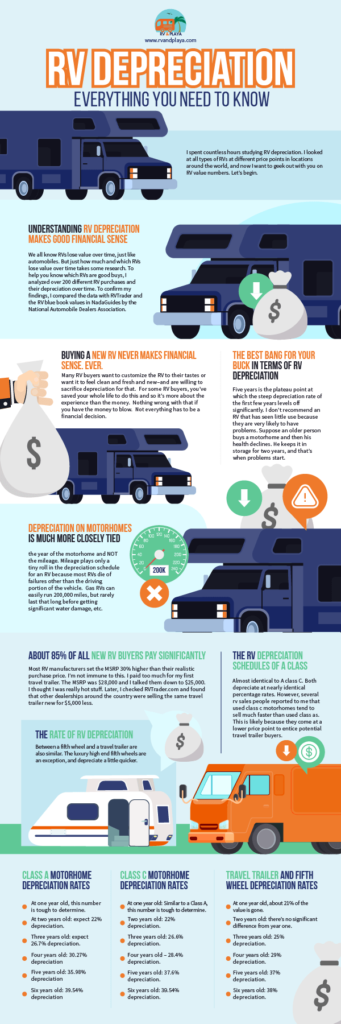

On average The RV depreciation rate is around 21% of the total purchase price in the first year of buying (meaning 21% of the price you paid new is now gone). After 5 years, you can expect to lose around 40% of the new price.

After the first 5 years the RV depreciation rate is more stable therefore it is best to buy an RV that is 5 years old which has seen medium use.

Table of Contents

What Is Depreciation Value?

Depreciation refers to the decreasing value of an object that happens naturally as the object is used and/or ages.

You may well have heard the term “total depreciated value” and were pretty confused as to what it really means.

Well, this is simply the value of the object once you’ve taken all its depreciation into consideration.

Generally speaking, you can calculate this with a specific mathematical formula.

This equation will consider the original monetary value of the object, the scrap value of the object, and finally, the projected age of the item.

Thus, you can determine the depreciation value for any object.

Although, it’s worth noting that sometimes, the value you end up with when you’ve conducted the calculation won’t be accurate.

Insurance companies, for example, view the depreciation value as either the calculated figure or the monetary amount you’d need to replace the exact product.

Here you can have a look on RV depreciation calculator.

RV Depreciation Method: What to Consider?

Some people will tell you to never buy a brand-new RV, but others will tell you to only buy a brand-new one.

Honestly, this one really splits the difference — and to tell you the truth, there isn’t a right or wrong answer. You do what makes sense to you.

Having said that, there are lots of factors to take into consideration when deciding. So, let’s have a look at some of them, shall we?

The State of The RV

For those of you who are seriously concerned with the depreciation value, the state of the RV you buy will be one of the largest considerations.

Make sure you remember that everything comes into play when figuring out the vehicle’s state.

Find out how much it has been used, how many miles it has done, and everything in between.

The State of The Economy

Depending on where you live, your economy will be vastly different.

So, ensure you’re clued up on this before you get started. If the economy is down, everyone will have less money and will be more frugal with their cash.

Conversely, if the economy is high, everyone will have more money and will be far less frugal with their dollars.

RV Depreciation Life or Schedule

The specific depreciation schedule for an RV depends on its type, brand, mileage, and so much more.

Later on, we’ll be discussing each type of RV and the corresponding depreciation schedule in detail.

But for now, let’s take a little look at the general depreciation life of an RV.

The First Year (20%)

This is when the most dramatic drop happens (sadly). Straight after you’ve bought the RV, the value will dip over 20 percent.

The Second Year (23.25%)

The value goes down an extra 3.25 percent but, in reality, this doesn’t make a difference.

The Third Year (28.33%)

By now, 30 percent of recreational vehicles will have broken down. So, if you’re considering expected depreciation before buying an RV, think about this.

The Fourth Year (32.17%)

Looking for an RV a bit older than this could save you (potentially) the massive costs of a huge mechanical failure.

The Fifth Year (39.37%)

Here, 80 percent of RVs will have broken down by now.

The Sixth to Ninth Year (42.27% to 50%)

This is the general range; it fluctuates somewhat wildly.

The Tenth to Twentieth Year (56.18% to 89.50%)

If you’re looking at RVs that are older than 20 years, you will quickly realize that the lowest prices tend to be somewhere between $2,000 to $3,000.

Related reading: Is RV Rental Worth It? 11 Things To Consider

What Is IRS Depreciation Tables for RV?

For those of you who are using your RV as a business, you can expense the depreciation straight away to give you some of the money back.

This is especially easy if you use your RV solely for business but even if you split it between personal too, you should be able to claim.

If you placed your recreational vehicle in service after December 31, 2017, you are allowed to follow the new law that was passed to expand the definition of section 179 property (i.e. the section that includes depreciation of RV).

Under these fab new regulations, you can choose to include the following in your depreciation expense claim:

✔️ Improvements to the interior of your RV unless it was conducted to ensure the internal framework stays intact.

✔️ New security systems, fire protection systems, alarm systems, and roofs.

✔️ New heating, ventilation, and air conditioning units.

The largest allowable depreciation of RV deduction (if you aren’t claiming bonus depreciation, which we discuss later) is the following:

? The first year = $10,000

? The second year = $16,000

? The third year = $9,600

? Each taxable year after this = $5,760

If you are claiming 100 percent bonus depreciation, however, the largest deduction is the following:

? The first year = $18,000

? The second year = $16,000

? The third year = $9,600

? Each taxable year after this = $5,760

Depreciation Factors to Consider

When purchasing an RV or motorhome, you should seriously have depreciation in mind.

Why? Because it plays a huge part in the resale value (and how much money you personally save).

Here are some of the things you need to think about.

Read also: Do RV Renovations Reduce Resale Value? (8 Tips To Increase Resale Value)

Think About The Age of Your Recreational Vehicle

Straight off the bat, if you are looking for an RV or motorhome straight off the forecourt, you should expect to lose roughly 21 percent of the price you just paid.

This 21 percent typically goes as soon as you drive it off the lot.

Yep, just like cars, RVs depreciate pretty quickly.

However, that shouldn’t necessarily put you off buying a recreational vehicle that’s brand new.

If you’re deciding to buy a new one for reasons other than monetary factors, then you’re good to go.

For example, if you want to customize every aspect of your fancy RV or you want that new, luxurious, clean feeling, then go ahead and grab an RV off the forecourt.

Alternatively, if you have saved for years and years for the perfect motorhome and that happens to be a brand-new one, go for it.

You do not have to make every decision with your bank account in mind. You do you.

But, if you’re looking for our advice, you will (typically) get the best bang for your buck when you purchase an RV that is around 5 years old with medium use.

You might be thinking, “surely little use is better”. If you are, that’s understandable. However, 5-year-old RVs that have only been used a little bit are far more likely to have serious issues.

What problems, we hear you ask? The following:

❌ A corroded water heater. This tends to come from water left in the bottom of the tank for a long time.

❌ Broken slides. If the RV has been stood stagnant for a long time won’t have been tended to. This means the slides won’t have been greased in ages.

❌ Internal water damage. This comes from little cracks that may not have been noticed if no one has been regularly maintaining the RV.

In short, you’ll end up paying a lot of extra money.

Disregard The Mileage (When Thinking About Depreciation At Least)

Generally speaking, depreciation of RV is linked with the age of the motorhome and not necessarily the mileage.

While the latter does play a role, it’s a minute one compared to the vehicle’s age.

Why is this the case? Well, RVs tend to sputter and die from reasons other than the driving part.

The engines in gas campervans can run well around 200,000 miles.

But, they don’t (usually) get there since they’ll incur some sort of water damage or a similar problem.

Just Remember This — 85%

The sad truth is that around 85 percent of new RV purchasers will pay far more for the vehicle than they should.

Manufacturers set the MSRP value approximately 30 percent higher than the recreational vehicle could really be bought for.

For those of you who fell into this trap, don’t worry. Pretty much everyone has done it before — whether when purchasing an RV or something else entirely.

After all, it’s easy to do since manufacturers are intent on making increasingly more money (who wouldn’t though, let’s face it!).

Class A to Class C Depreciation is Almost The Same

Oddly, used Class C motorhomes sell a lot faster than Class A ones. But don’t think this is because these ones depreciate slower.

That’s not the case. It appears to be simply because used Class Cs are wildly cheaper than their counterparts.

Fifth Wheel Vehicles to Travel Trailer Depreciation is Almost The Same

While the luxury fifth wheel vehicles might depreciate a tad quicker, the difference is so minute that it might as well not exist. So, don’t be fooled here either.

The Date Placed in Service

If you use your RV as soon as you obtain it, then you can easily figure out the date it was placed in service since it’ll be the same day you paid for it!

However, if you did not use it straight away, it might be harder to figure it out. Nevertheless, you’ll need it to accurately calculate the depreciation of your RV.

The Acquisition Value

This term is used to refer to the value of your campervan once its useful life is over.

The Salvage Value

Assets like buildings are usually written at historical cost. However, if something is pretty valuable, you will need to have it appraised by a professional.

This might be necessary for your RV. But nine times out of ten, you can make a good estimate yourself by researching sold costs on eBay.

The Useful Life Estimation

This term is used to refer to the estimated number of years your RV can be used for its original purpose.

For most recreational vehicles, this will be roughly 20 years.

The Depreciation Method

If you plan to use the straight-line method of calculating depreciation, then you would use the following calculation:

- Depreciation = acquisition value – salvage value/estimated useful life

- In other words, this is depreciation equals acquisition value minus salvage value divided by estimated useful life.

Here, your vehicle will be effectively written off at consistent intervals over its useful lifetime.

This doesn’t actually equate to how your campervan will depreciate in the real world (as we displayed earlier).

What Is MSRP?

MSRP stands for the manufacturer’s suggested retail price. Put simply, this is the monetary amount that the manufacturer of an item suggests the product is sold for.

The same term is also used as the list price, depending on the retailers’ preferences.

Every single product made can come with a manufacturer’s suggested retail price. However, this value is typically used with vehicles like cars, trucks, and of course, RVs.

Appliances and high-end electronics typically come with an MSRP too.

This figure was originally made to ensure each shop placed products on its shelves at the same price. However, retailers don’t necessarily use this price point.

Therefore, you may well be paying more (or less) than the MSRP when you buy certain items.

Typically, retailers will hike the prices up if they know an item will be popular and will essentially disappear off the shelves.

Why Would Retailers Charger Less Than the MSRP?

Usually, retailers might place products on their shelves at a lower price. This helps them to shift items that might not be selling in a particularly slow economy.

Alongside this, sale prices will generally be lower than the manufacturer’s suggested retail price.

The same goes for items that are on clearance and those products that need to have their inventories reduced.

Depreciation Rates by RV Type

Earlier, we discussed the general depreciation schedule of a recreational vehicle or campervan.

Well, now we are going to take a look at the depreciation schedules of the various classes and types of RVs.

This will give you a more accurate idea of how your vehicle (or the vehicle you’re wanting to purchase) will depreciate/has depreciated.

Of course, do remember that these are the average depreciation schedules. We can’t ever say for sure how your specific make and model will depreciate.

However, as we said, our estimations will give you a good idea.

Depreciation of a Class A Recreational Vehicle

In the table below you can find the average class A RV depreciation rate:

| Years after Purchase | Depreciation Rates (%) |

|---|---|

| One Year Old | To tell you the truth, the first depreciation percentage is the hardest to figure out. After many deliberations, we’ve figured that it’s around 20 to 21 percent. This number is so hard to determine because dealerships tend to ramp up the price of vehicles that have actually been traded back in (i.e. are no longer brand new). |

| Two Years Old | Here, your vehicle will be around 22 percent depreciated. As you can tell, there isn’t much of a difference from the first year. Generally, manufacturers will call their vehicle a 2020 model even though it was released in 2019 so it can be hard to tell. |

| Three Years Old | By now, your RV will be roughly 26.7 percent depreciated. This means that 26.7 percent of the amount you paid for your vehicle is gone forever. |

| Four Years Old | 30.27 percent depreciated |

| Five Years Old | 35.98 percent depreciated |

| Six Years Old | 39.54 percent depreciated |

| Seven Years Old | 41.15 percent depreciated |

| Eight Years Old | 43.16 percent depreciated |

| Ten Years Old | Here, it will be around 60 percent depreciated. The reason for this is because potential buyers think that 10 years old is a lot worse than 9 years old. |

| Thirteen Years Old | 69 percent depreciated |

| Fifteen Years Old | 76 percent depreciated |

| Twenty Years Old | 86 percent depreciated |

| Twenty Nine Years Old | By now, it’s around 96 percent depreciated. |

| Thirty Years Old and Over | Generally speaking, the price will stick at around $2,000 to $5,000. Why? This is due to the fact that, as long as it’s still driveable, someone will want it. |

Depreciation of a Class B Recreational Vehicle

In the table below you can find the average class B RV depreciation rate:

| Years after purchase | Depreciation rates (%) |

|---|---|

| One Year Old | Just like the Class A motorhome, your Class B recreational vehicle will have depreciated about 21 percent at this time. Again, this is hard to figure out accurately due to trade-ins. |

| Five Years Old | 49 percent depreciated |

| Ten Years Old | 65 percent depreciated |

| Twenty Years Old | 84 percent depreciated |

| Twenty Five Years Old | 88 percent depreciated |

| Thirty Years Old | Here, you should expect to get around $8,000 for your Class B recreational vehicle. However, after this age, the value becomes almost 100 percent depreciated. |

Class B recreational vehicles depreciate quite consistently. Generally speaking, it depreciates roughly 9 percentage points every five or so years. Having said this, there is a pretty big drop between five years and ten years that breaks this mould.

Depreciation of a Class C Recreational Vehicle

In the table below you can find the average class C RV depreciation rate:

| Years after purchase | Depreciation rates (%) |

|---|---|

| One Year Old | It will be roughly 21 percent depreciated here. Although, due to trade-ins, it’s hard to work out accurately. |

| Two Years Old | 22 percent depreciated. Just like the other classes we’ve spoken about, there isn’t much difference between a one-year-old and a two-year-old RV. |

| Three Years Old | 26.6 percent depreciated |

| Four Years Old | 28.4 percent depreciated. If you’re comparing, this is better than the Class A RVs by two percentage points. |

| Five Years Old | 37.6 percent depreciated. If you’re comparing, you might be interested to know that this is a tad worse than the Class A campervans by 2 percentage points. |

| Six Years Old | 39.54 percent depreciated |

| Seven Years Old | 40 percent depreciated |

| Eight Years Old | 44 percent depreciated |

| Ten Years Old | 51.96 depreciated |

| Thirteen Years Old | 64 percent depreciated |

| Fifteen Years Old | 69 percent depreciated |

| Twenty Years Old | 83 percent depreciated |

| Thirty Years Old and Over | If the vehicle is still driveable, then you should be able to sell it for around $3,000. |

Depreciation of a Fifth Wheel and a Trailer

In the table below you can find the average Fifth Wheel depreciation rate:

| Years after purchace | Depreciation rates (%) |

|---|---|

| One Year Old | Again, this is hard to calculate. But, it will have depreciated by roughly 21 percent. |

| Two Years Old | No notable difference from year one here. |

| Three Years Old | 25 percent depreciated |

| Four Years Old | 29 percent depreciated. This is better than a Class A RV by two. |

| Five Years Old | 37 percent depreciated |

| Six Years Old | 38 percent depreciated |

| Seven Years Old | No significant difference from the sixth year here. |

| Eight Years Old | 40 percent depreciated |

| Ten Years Old | 45 percent depreciated |

| Fifteen Years Old | 72 percent depreciated |

| Twenty Years Old and Over | Here, the price will be anywhere between $3,000 and $5,000 depending on the state of the vehicle. |

Truck Camper Depreciation

In the table below you can find the average truck camper depreciation rate:

| Years after Purchase | Depreciation rates (%) |

|---|---|

| One Year Old | 15 percent depreciated |

| Five Years Old | 24 percent depreciated |

| Ten Years Old | 50 percent depreciated |

| Fifteen Years Old | 70 percent depreciated |

| Twenty Years Old | 76 percent depreciated |

| Thirty Years Old | The price will hover around $5,000 if the vehicle is in good working order. |

Related reading: Top 35 Best Pop Up Camper: Pop Up Trailer Tents You Need To Know

Which RVs or Motorhome Hold Their Value the Best?

Even though Class A RVs are incredibly luxurious and the Class C options are cheap yet cheerful, this doesn’t mean they hold their value.

If resale is one of your biggest priorities, you will want to opt for a Class B RV.

Consumer Reports have shown that almost all Class B models hold their value better than the others. The best part is, they can be practical as well as pretty luxurious.

You basically get the best of both worlds. Depending on the exact one you purchase, you might also receive blind-spot monitoring technology!

Mercedes-Benz, Ram, and Ford make (arguably) the best Class B RV chassis.

Just keep in mind that they are pricey for the size. However, they’ll definitely give you a comfy resale value.

We suggest you go for one of these 5:

✔️ Airstream Interstate 24GT

✔️ Winnebago Revel RV

✔️ Leisure Vans Unity Murphy Bed RV

✔️Auto Campers’ Day Van

✔️ Jayco RVs

Related reading: Campers for Rent | Get a Camper Rental From Outdoorsy Today!

Which RV Brands Hold Their Value Best?

RV depreciate in values rapidly. The higher end brands typically hold up better to wear and tear and have a certain cachet that makes them more desirable on the used market.

In my opinion the RV brands which hold their value best are:

? Newmar

?Monaco

?American Coach

?Country Coach

? Wanderlodge

For Trailer I would recommend following brands:

? Carriage/Carrilite

? Nuwa (Hitchhiker)

? Montana

? Cardinal

How to Find The Value of My RV

There are a few ways to figure out the value of your RV. We suggest you use a combination of the three we’re going to discuss to find the most realistic value.

Let’s get straight into it, shall we?

Method One: Consult Price Guides / Nada RV

This tends to be the first place you look. These guides (such as Nada guides) provide a value range for certain models and base their prices on the depreciation of a new RV.

Therefore, this value won’t necessarily reflect the price you purchased your vehicle for. Thus, it might not be accurate. For more check out the nada RV.

Method Two: Online Sales

Head to a secondhand site like eBay and search for your specific make and model of RV.

Filter the results so that it only shows you “sold” items. This will help you price yours accordingly.

In other words, it gives you a valuation of what people are prepared to pay for it in the current climate.

Method Three: Get a Professional Appraisal

If you choose this method, you might end up forking out a lot of money since they start at $200!

However, it does mean that your RV mechanic will take a proper look over your vehicle and consider its value.

The best part about this method is the pro won’t have any bias toward picking a more favorable value.

How Do I Depreciate My RV Business?

The first thing to understand when you are trying to depreciate your RV business is the type of RV rentals available.

Residential Rental

If you fit in this category, you will be splitting your RV between personal and rental use.

If you are using your recreational vehicle more than 10 percent of the days rented to strangers, you have to prorate your RV expenses.

The thing to remember here is that “personal use” means use by those in your family and anyone who is paying less than a standard rental.

For those of you who rent your campers out fewer than 15 days per annum, you don’t need to report any income you receive from it. You can’t take any deductions either.

Business Use

You’ll qualify for section 179 deductions if you don’t use your RV for entertainment or personal reasons at all.

Bear in mind that you don’t qualify if you live in your vehicle full-time though.

Rental Use

If you list your RV on rental sites, you’ll be in this category. You’ll qualify for section 179 deductions here if you work at it regularly and are continuously improving and advertising.

Put simply, here’s how you qualify for the section 179 deduction with your RV rental:

- Follow the IRS depreciation tables we discussed earlier (RV depreciation IRS).

- Don’t use your RV yourself.

- Don’t rent for less than a fair price.

- Don’t allow any family to use your RV.

Depreciation Of RV FAQs

Let’s close out this page about depreciation of RV with answers to some of your most frequently-asked questions about them!

1. How Long Will an RV Last?

This is quite a difficult question to answer outright since it depends on how you’ve been using it, how often you’ve been using it, and the class of RV you’ve purchased.

But we’ll give you a bit of an idea!

On average, campervans tend to last roughly 20 years. This translates to roughly 200,000 miles.

Usually, it’s whichever one of these comes first. But as we mentioned, this does depend on a few other factors.

So, if in doubt, ask your local expert!

2. Why Do RVs Depreciate So Fast?

There are a few reasons why RVs depreciate so fast. Have a gander at the following:

- Just like buying a car, the minute the RV comes off the forecourt, you’re losing money. In this sense, it’s never financially sensible to purchase one.

- It’s linked to the motorhome build itself and not the mileage (generally speaking).

- It’s likely that you paid far more for your RV than it’s actually worth.

- No difference in depreciation schedules of a Class A compared to a Class C.

3. Does an RV Qualify for Section 179?

To figure out whether your RV qualifies for section 179, you need to consider how you use the vehicle. We looked at this earlier, however, here’s a recap if you need one.

Residential Rental

If you split your camper between rental and personal use, this is the category for you.

You need to pay extra attention to how often you’re using it for rental purposes and vice versa.

Your RV rental will only qualify for section 179 tax deductions if you are using the vehicle for business more than 50 percent of the time.

For those of you who don’t get 50 percent or more business use out of it, you will still be able to depreciate it at the standard rate.

Business Use

If you’re using your RV for business only, then you’ll qualify for section 179.

Rental Use

If you are renting your RV out to strangers all the time, you qualify for section 179.

How? It’s due to the activities involved in the rental qualify as a regular business in the mind of the taxman.

4. Which is Better Section 179 or Bonus Depreciation?

Bonus depreciation and section 179 are almost always confused. And the truth of the matter is, they both do similar things.

The main difference, however, is that bonus depreciation allows you to get the cost back over time and section 179 allows you to immediately expense costs.

Neither of them is better than the other.

So, to help you make up your mind, here are the key points for both.

Bonus Depreciation:

- No yearly deduction limit

- Isn’t as flexible

- Can be bigger than the income from your business

Section 179:

- Yearly deduction limit

- Timing flexibility

- You’ll be covered on real estate improvements

The Bottom Line

And there you have it! You’re pretty much an expert on recreational vehicle depreciation by now.

So, what are you waiting for? Go and buy your dream campervan at the best price! You’ll never be ripped off again.

References

https://www.nadaguides.com/RVs/shopping-guides/how-much-do-campers-depreciate

https://www.nationalfunding.com/

Recent Posts

RV Sidewall Delamination – How To Fix Delamination In Motorhomes

Taking care of your RV is important to keep it running and ready for family road trips for years to come. When the siding on the RV begins to look bubbled or wavy, the vehicle might have some RV...

Being a travel trailer owner is a rewarding and enlightening experience for you and your family. The weekend retreats and vacations will create lasting memories that bind your family in love and...